15 DEC, 2023

Financial Literacy and Investment Behaviour of Tertiary Students in Hong Kong

Written by : Angus Chan

An Investor and Financial Education Council (IFEC; previously the Investor Education Centre—IEC) survey conducted in 2021 found that 22% of students and 39% of young working adults (18-29) owned investment products, representing a significant increase from 2019, where the figures were 2% and 26% respectively (IFEC, 2022).

Yet despite the considerable participation of young people in financial markets, not much is known about how this group of investors behave in terms of portfolio characteristics, loss-absorption capacity, and means through which they gain investment-related information. This is especially the case when it comes to students studying in tertiary educational institutions at higher diploma, associate degree, or degree levels. This lack of understanding means that it is difficult to assess the investment patterns of these investors and, more importantly, how shocks in financial markets will impact the wellbeing of these young investors.

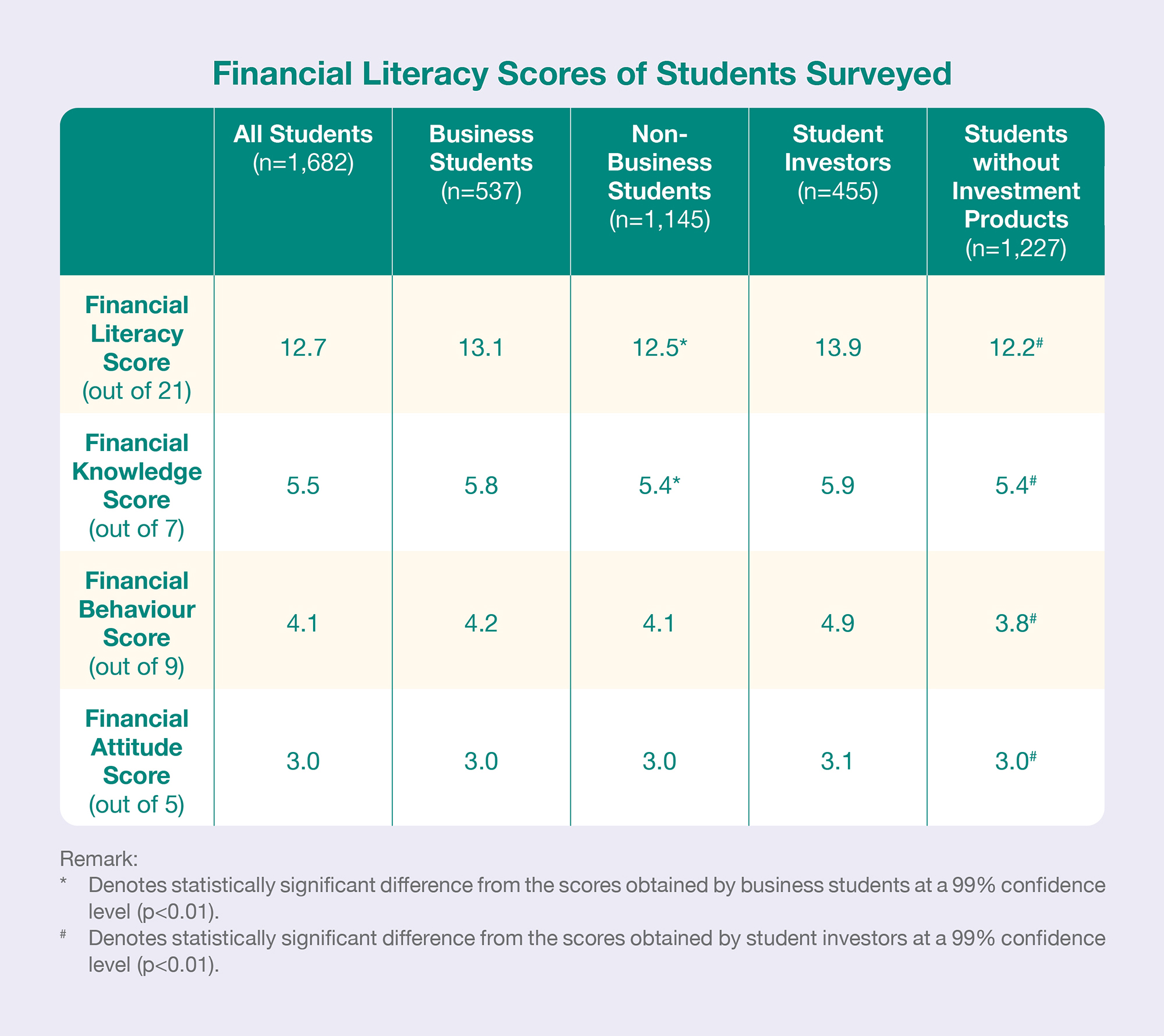

In order to provide a clearer picture of the investment patterns of young people and the factors they consider when making investment decisions, MWYO conducted a survey from August to November of 2022 in tertiary educational institutions in Hong Kong. We surveyed 1,926 students studying in tertiary educational institutions in Hong Kong via online survey and collected 1,682 completed responses. The response rate is 87.3%.

This research seeks to identify whether young people are investing in products that they have limited knowledge about. In addition to understanding the investment patterns of young people, this research will also seek to learn more about the sources through which young people obtain investment-related information. This will allow financial education institutions to better adapt their financial education programmes and disseminate reliable information through means that young people are more receptive towards.

Key Findings:

-

Financial literacy of tertiary students is low.

-

Students do not feel they have enough knowledge about investment products.

-

Student investors do not have well-diversified investment portfolios.

-

Student investors have limited loss-absorption capacity.

-

Student investors' investment choices do not always align with investment objectives.

-

Student investors rely on their own judgement when making investment decisions.

-

Studnets prefer visual sources of investment information.

Policy Recommendations:

-

Increase regulation on the provision of investmjent advice on social media platforms.

-

Launch a Youth Bond only available to young people.

-

Raise age limit for access to credit facilities.

-

Tertiary educational institutions should provide more financial literacy training.